Meat Processing Business Overview

By Vishnu Sultania, Avinash Singh

Introduction

Meat processing refers to process of Slaughtering, Butchering, Curing and Smoking to increase shelf life, and packaging of animal meat. Meat processing helps to produce value added, variety and convenience meat products to meet lifestyle requirements. Meat processing is growing market due to factors like urbanization, new processing technologies, fast paced lifestyle among others.

Processed Meat Scenario in India

With over 65% of the population being non-vegetarian, chicken and fish dominate consumption. Per capita meat consumption exceeds 4.9 kg, with a growing preference for processed options like salted and smoked products. India annually exports over 7,000 metric tons of poultry meat. Presently, frozen meat exports reach 60 countries, with major buyers including Malaysia, Egypt, UAE.

Market Outlook

According to a report by Statista, revenue in the Indian processed meat market amounts to US$ 2.72 billion in 2024 and is expected to grow annually by 6.05% (CAGR 2024-28). While India’s raw meat exports reached a value of US$ 3.6 billion in 2023, growing by 12.1% YoY, export of Processed meat products is much lower at US$ 2.65 Million, growing by 57.2% YoY (Source: APEDA). A large share of export of raw meat products is taken up by Buffalo meat (US$ 3.2 billion out of 3.6 billion). Globally, India ranks 5th in terms of production volume and ranked 13th in terms of exports globally, reflecting the industry’s increasing prominence on the international stage. India is the 4th largest exporter of frozen buffalo meat. In global comparison, most revenue is generated in the United States (US$42bn in 2024).

Opportunities in Meat Processing Industry in India

India has enormous untapped potential in the meat processing industry due to following:

• India has the world’s largest population of livestock.

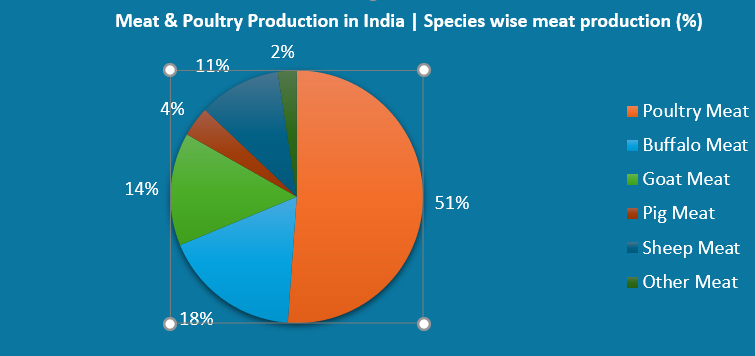

• India produces around 9.7 million MT of Meat and 138.38 billion eggs annually (As per 2022-23 Data).

• India ranks 2nd in Egg Production and 5th in meat production in the world. (FAOSTAT production data 2021)

• The current processing levels in poultry are 6%, while for meat it stands at 21%., which is still low. (2019 Data).

Competition Landscape

According to reports, there are about 8000 registered and more than 20,000 unregistered slaughterhouses in the country and most of them are devoid of basic amenities like light and ventilation. Only 77 abattoirs have meat processing facilities approved by the Agricultural and Processed Food Products Export Development Authority (APEDA).

Key Players in the Meat Processing Sector

1. Venky’s: Also known as Venkateshwara Hatcheries Pvt. Ltd., Venky’s is Leading player in poultry processing. Group owns modern integrated processing plants across India and operating a 100% export-oriented egg powder plant in Hyderabad. The company diversified its activities to include SPF eggs, chicken and eggs processing, broiler and layer breeding, genetic research and Poultry diseases diagnostic, Poultry vaccines and feed supplements, vaccine production, bio-security products, Poultry feed & equipment, nutritional health products, soya bean extract and many more. [Source: Venky’s India limited (a BSE listed co.)]

An overview of the financial performance of Venky’s:

| Company name | Year | Revenue from poultry Segment (INR in crores) | Profits from poultry Segment (INR in crores) | Profit Margin |

| Venky’s India Limited | 2024 | 1,755 | 47.5 | 3% |

| 2023 | 1,752 | 54.3 | 3% |

2. Godrej Tyson Food: After Venky’s, the only other large modern facilities is the Godrej Tyson Food Ltd. (GTFL). Godrej Tyson produces and sells frozen chicken segments under Good Real Chicken and Snacks like nuggets under the Yummiez brands. This is the only multinational in meat processing in India.

An overview of the financial performance of GTFL:

| Company name | Financial Year | Revenue (INR in Crores) | Profits before tax (INR in crores) | Profit Margin |

| Godrej Tyson Food Limited | 2024 | 988 | 49.87 | 5% |

| 2023 | 1,004 | 13.2 | 1.3% |

As per latest annual report, profitability has increased by 277%, due to sustained operational efficiencies and consistent performance in branded products.

3. Allana Sons (APL): APL is the largest exporter of buffalo meat, majorly frozen buffalo meat, which constitutes 80% of the sales of the company. APL Operates a modern abattoir in Aurangabad (Maharashtra), acquired in the early 1980s, with a capacity of 500 buffaloes per day. It is an advance technology plant utilizes all parts of the animal, including blood and skin. Group has established dealer and distributor networks in Middle Eastern countries, giving it a competitive edge. Group accounts to 50% of the India’s meat export.

(Source: Allanasons Pvt Ltd)

An overview of the financial performance of GTFL:

| Company name | Financial Year | Operating Income (INR in Crores) | Profits after tax (INR in crores) | Profit Margin |

| Allanasons Pvt Ltd | 2023 | 8,724 | 314 | 4% |

| 2022 | 8,135 | 160 | 2% |

4. Other Notable Processors: Various processors in Uttar Pradesh and Maharashtra regularly export fresh frozen and processed meat products. These include Lazzez, Al Kabeer, Al Sami, and Al Nasir, many of which have developed their own brands and cold chain networks for the domestic market.

Factors Driving Growth

Technology advancement: The variable meat preservation techniques have resulted in the voluminous growth in the demand for fresh processed meat and meat processing machinery industry globally is growing at a very strong pace, driven by technological advancement. AI powered vision systems can now assess meat on various quality parameters, optimise cutting processes and minimise waste. Food testing labs, Cold chain facilities are another push to the industry.

Urbanization: To suit the fast-paced city life, urban consumers prefer eating Processed Meat. The time required to cook raw meat and then serve it is likely to continue to opportunely aid the growth in demand for processed meat. Processed Meat is widely accepted as the ideal fast-food product and is popular among the working class of society. The global processed meat market is expected to witness an upsurge due to existing fast-food practices’ dominance.

Expansion of Fast-Food Chains:The rapid expansion of fast-food chains such as Subway, KFC, McDonald’s, Burger King has had a noteworthy influence on mounting processed meat consumption.

Government Support

Following Key fiscal incentives to promote food processing industry are introduced by Indian Govt.:

- Lower GST for raw and processed product; more than 70% food products are covered in lower tax slab of 0% & 5%.

- Concessional rate of Custom duty on imported equipment (under project import benefits)

- 100% income tax deduction on setting up/operating cold chain or warehouse for storage of agriculture produce.

Challenges Faced by the Meat Processing Industry

Largely Unorganized: meat sale largely happens through small independent retailers in India. Further, most of the sales is through offline modes (almost 90%). Meat products sale through online means has yet to pickup it pace in India, this present opportunity and challenge as well.

Infrastructure is Inadequate: India has production capacity however the capacity is bottlenecked by absence of cold chain facilities which is hampering the growth of processed meat industry.

Diseases and infections of livestock: The frequent outbreak of infections like the foot and mouth disease, black quarter infection, and influenza severely impacts livestock health and lowers productivity.

Greenhouse gas generation: The generation of greenhouse gases by the humongous population of herbivorous animals in India. Reducing the emissions through mitigation and adaptation strategies is a major challenge.

Breeding issues: Crossbreeding of indigenous species with exotic stocks to enhance the genetic potential of different species has been successful only to a limited extent. Limited Artificial Insemination services owing to a deficiency in quality germplasm, infrastructure and technical manpower coupled with poor conception rate following artificial insemination have been the major impediments.

Health concerns: The World Health Organization has classified processed meats including ham, bacon, salami and frankfurts as a Group 1 carcinogen (known to cause cancer) which means that there’s strong evidence that processed meats cause cancer. Eating processed meat increases risk of bowel and stomach cancer. Nevertheless, the companies are expected to boost the demand by developing advanced processing that renders the product meat harmless and prevents post-consumption stomach ailments.

Legislation: The beef in India also means buffalo meat and not cow meat as is known the world over. Cow slaughtering is banned and hence no cow meat is now offered for international trade. The cattle trade and more particularly interstate cattle trade have suffered because of the new legislation.

Key Trends Shaping the Industry

Plant-Based Meat: these products are designed to replicate the taste, texture, and appearance of traditional meat, but are made from plant ingredients such as soy, pea, lentils etc. The rise of plant-based meats is gaining traction as consumers seek healthier, sustainable options. Segment’s some of the Indian start-ups are GoodDot, ImagineMeats etc. The global plant-based meat market size was valued at USD 7.17 billion in 2023 and is expected to grow at a CAGR of 19.4% from 2024 to 2030. This emerges as opportunity and challenge as well to the meat industry.

Online and Direct-to-Consumer Sales: The growth of e-commerce has transformed meat sales, with more companies offering direct-to-consumer delivery options. For e.g., Licious founded in 2015 one of the largest players in this category has clocked revenue of Rs 78.96 crore in FY2019 to Rs 746 crore in FY2023, a growth of CAGR 57%.

Conclusion

The meat processing industry is experiencing growth and presents a favourable future outlook. Profitability is steady, with potential for increase in the coming years. However, the rise of alternatives and advancements in technology present both challenges and opportunities that, if effectively leveraged, could enhance market positioning.

ABOUT THE AUTHOR (S)

Vishnu Sultania is the Managing Director at AKMV Consultants, and a financial advisor to United Nations UNDP; Avinash Singh is a qualified Chartered Accountant and serving as a Finance Analyst at AKMV Consultants.